|

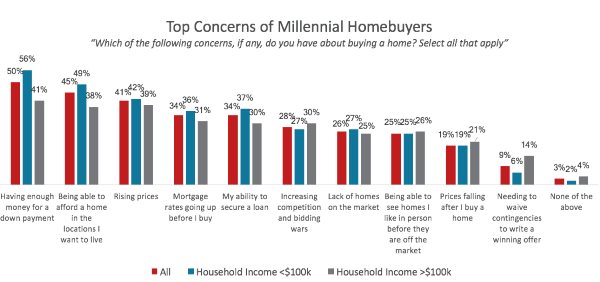

According to a recent survey, the top concern among first-time millennial homebuyers was having enough money for a down payment, with 50 percent citing that response, followed by affording a home in their preferred location (45%) and rising home prices (41%).

Redfin commissioned a survey of 2,000 U.S. residents who planned to buy or sell a primary residence in the next 12 months. The purpose of the survey was to better understand the objectives, perspectives and concerns of those about to enter the real estate market.

Aside from the 69 percent who saved directly from paychecks, millennials used several tactics and sources to accumulate the money needed for a down payment on their first home. Thirty-six percent used earnings from a second job, 13 percent pulled money out of retirement funds early and 10 percent sold cryptocurrency. Some were lucky enough to have received a cash gift from their family (24%) or an inheritance (12%).

When broken down by household income levels, there were some notable differences in how millennials achieved a down payment. Millennials in households earning more than $100,000 per year were less likely than those earning less to have saved directly from paychecks, with 60 percent of high-earners having done so, compared with 75 percent of those who earn less than $100,000. Millennial households earning more than $100,000 were more than three times more likely than their less-well-off peers to have sold cryptocurrency investments and twice as likely to have sold stock investments. They were also more likely to have received an inheritance or cash gift from family or to have dipped into their retirement savings.

To afford a mortgage, 65 percent of millennials who intend to buy their first home this year plan to take some action, aside from just paying from their regular paychecks:

32% plan to pursue additional employment

19% intend to rent out a room to someone they know

15% say they will drive for a ride-sharing service

14% plan to split ownership of the home with friends or roommates

Source: RedFin

What Happened to Rates Last Week?

|