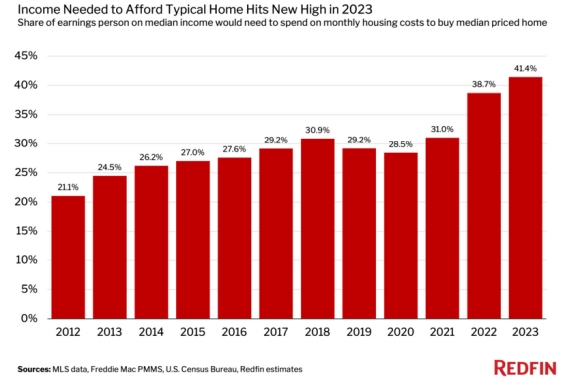

Someone making the $78,642 median U.S. income in 2023 would’ve had to spend 41.4% of their earnings on monthly housing costs if they bought the $408,806 median-priced U.S. home. That’s the highest share on record and is up from 38.7% in 2022. That’s according to a Redfin analysis that estimates monthly housing payments for the […]

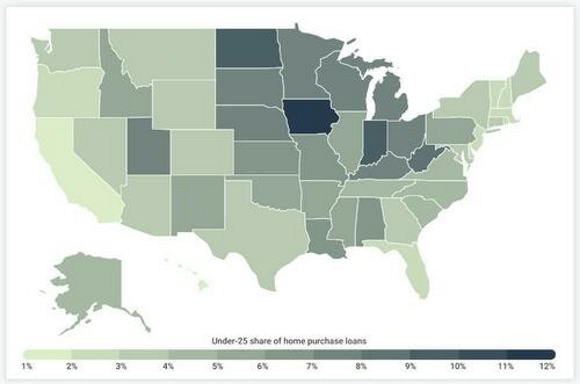

The newest generation of homebuyers are flocking to the Midwest. Cities with the most homebuyers under the age of 25 are located in this more affordable part of the country, a new study released by Construction Coverage found. The study used data from the Federal Financial Institutions Examination Council’s 2022 Home Mortgage Disclosure Act, and […]

If you look at where $250,000 in household income buys you the most house, all of the top ten cities are in the South. The purchasing power of a $250,000 salary, for instance, depends largely on a city’s cost of living and overall tax environment. High earners might be able to maximize their earnings and […]

The answers might surprise you, as the classic home improvement projects homeowners are most interested in, such as sparkling new kitchens and baths, rarely deliver the return on investment they expect. Actually, the top projects with the greatest returns in resale value are more often related to a home’s curb appeal. Homeowners can expect a 100% […]

The Mortgage Bankers Association said that Mortgage applications for home purchases increased in April as demand for newly built homes grows amid the housing supply shortage. Data from MBA’s Builder Application Survey showed that purchase applications for new homes in April rose 4.1% year over year but were down 11% month over month. Despite the monthly decline, […]

The rebounding home construction business has gotten antsy over lumber costs. Between April 1 and Aug. 27, commodity traders bid up lumber to $850 per 1,000 board feet from $260 according to MacroTrends. That’s a 227% jump up off a four-year low to a record high. The National Association of Home Builders estimates lumber’s spike would […]

The Data & Analytics division of Black Knight, Inc., released its latest Mortgage Monitor Report, As 30-year interest rates hit a record low in recent weeks, Black Knight looked at the impact this has had on refinance incentive, affordability levels, and their broader impact on the mortgage and housing markets. As Black Knight Data & […]

For those who have considered downsizing – HomeAdvisor has compiled a list of the most popular states for tiny home living. The site used geolocation data from Instagram posts containing the #tinyliving hashtag was used to determine the best areas. The #tinyliving movement may sound cute, but it is driven by a fierce desire to […]

Investors rushed to snatch up properties to resell for a profit. Home flipping comprised 7.5% of all home sales during the first quarter, up from 7.3% a year prior, ATTOM Data Solutions reports in its 2020 Home Flipping Report. It defines a house flip as a purchase and sale within 12 months. The gross profit […]