The newest generation of homebuyers are flocking to the Midwest. Cities with the most homebuyers under the age of 25 are located in this more affordable part of the country, a new study released by Construction Coverage found. The study used data from the Federal Financial Institutions Examination Council’s 2022 Home Mortgage Disclosure Act, and researchers at Construction Coverage “calculated the share of all home purchase loans taken out by applicants under 25 years old.” The study says that only “conventional home purchase loans originated in 2022 were considered for this analysis”. The key points of the study found: As the study notes, millennials—those born from 1981 to 1996—now representing the largest age group in the United States and entering their prime years for acquiring their first or even second homes. These dynamics contribute to a surge of buyers vying for a diminishing pool of available properties. Freddie Mac reports that even before the pandemic hit, the housing market was facing an all-time low in supply.

- The total number of conventional home loans originated in 2022 was down across all age groups from the year prior. Among all age cohorts, 65–74 year-olds experienced the largest percentage decline, decreasing by 22.3%. Notably, the under-25 age group only experienced a 12.3% decline, the smallest of all cohorts and a sign of persistent housing demand from younger generations despite economic headwinds.

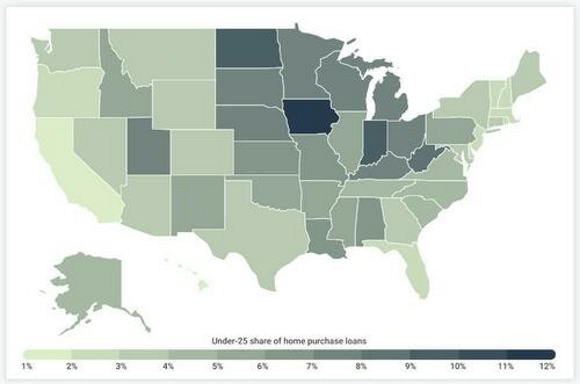

- Many of the states with the highest shares of home purchase loans from adults under age 25 are found in the more affordable Midwest, led by Iowa at 11.5%. The same trend holds at the local level, with many of the top metropolitan areas for young homeowners also found in that region.

- In contrast, high-cost coastal states including Hawaii (1.6%) and California (1.9%) have much lower shares of home purchase loans from young adults. In these areas, would-be young homebuyers face more expensive homes and higher living costs, creating a higher barrier to entry in these real estate markets.