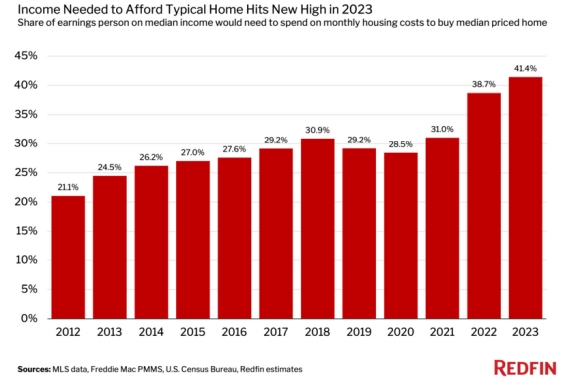

Someone making the $78,642 median U.S. income in 2023 would’ve had to spend 41.4% of their earnings on monthly housing costs if they bought the $408,806 median-priced U.S. home. That’s the highest share on record and is up from 38.7% in 2022.

That’s according to a Redfin analysis that estimates monthly housing payments for the typical homebuyer using median home sale prices, monthly mortgage rates (averaging 6.73% for 2023) and median household incomes, and the assumption of a 20% down payment, principal, interest, taxes and insurance.

To estimate 2023 median household incomes, they multiplied the available 2022 income data by the 2023 wage growth rate. Data for 2023 goes through October, while data from past years spans the full year. When we refer to a record high, we are referencing records dating back to 2012.

A rule of thumb in personal finance is that people should spend no more than 30% of their income on housing, but that has become less realistic due to elevated mortgage rates and home prices.

The typical 2023 homebuyer needed to earn an annual income of at least $109,868 if they wanted to spend no more than 30% of their earnings on monthly housing payments for the median-priced home. That’s a record high—up 8.5% from 2022—and is $31,226 more than the typical household makes in a year.